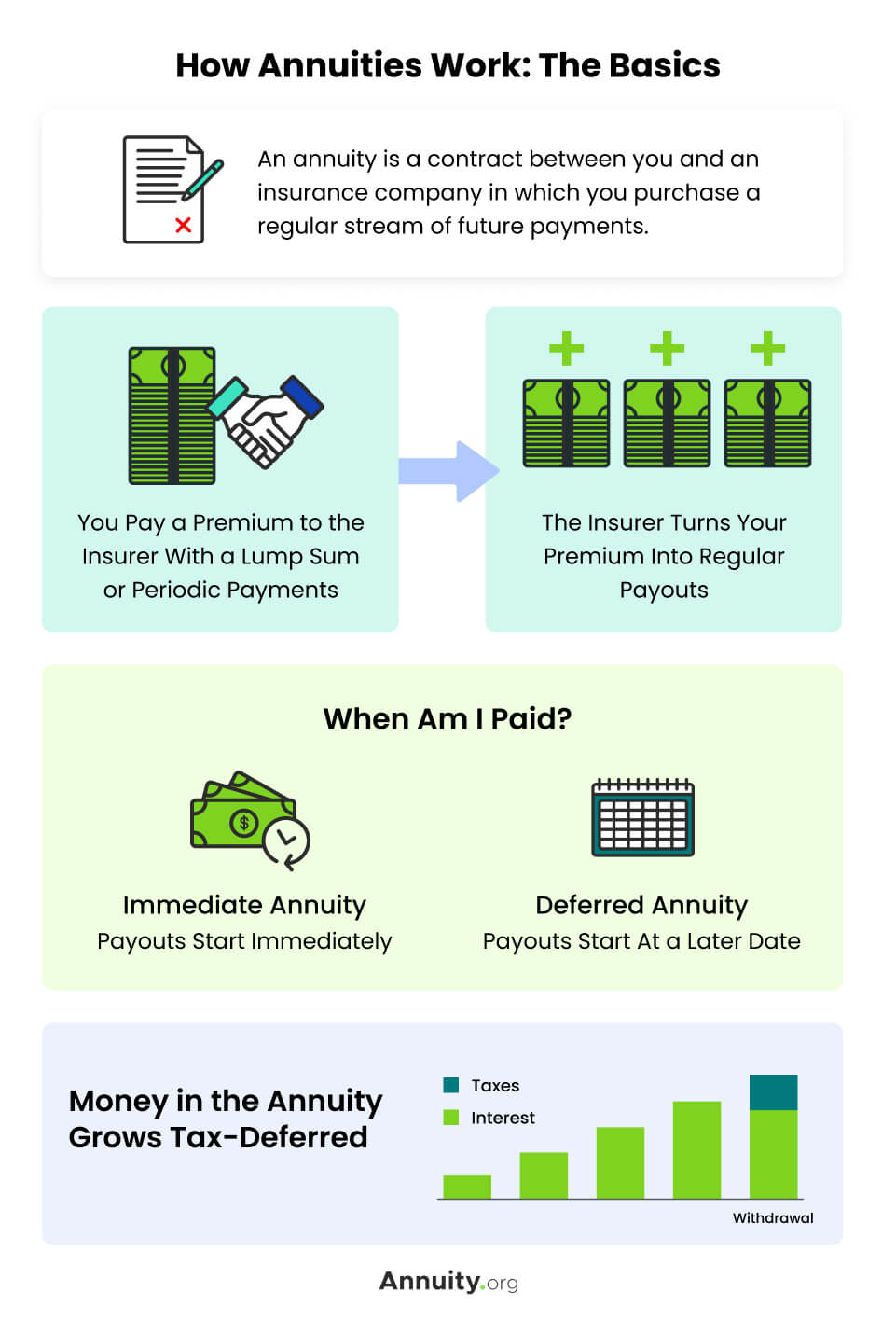

· an annuity is an insurance contract that exchanges present contributions for future income payments. You can buy an annuity contract alone or … Annuities are savings and income vehicles that can help increase & protect savings, generate income and provide tax-deferral. · an annuity is a contract that requires regular payments for more than one full year to the person entitled to receive the payments (annuitant). With income annuities, you give them a pool of your money, and they send it back to you as a stream of income. · an annuity is a contract with an insurance company. · an annuity is a customizable contract issued by an insurance company that converts an investor’s premiums into a guaranteed fixed-income stream. More specifically, an annuity … Annuities are the only product outside of a pension or social security that provide lifetime income guarantees. Annuities are tax-deferred investments that allow you to earn a post-retirement income — which means you can earn money even after youre off the clock. Sold by financial services companies, annuities can help reinforce your plan … · an annuity is a contract purchased from an insurance company with a large lump sum in return for regular payments, commonly used as an income source in retirement. An annuity is a contract between you and an insurance company to cover specific goals, such as principal protection, lifetime income, legacy planning or long-term … · what is an annuity? There are 2 basic types of annuities: They can help keep you from depleting your assets and running out of money in your … At its most basic level, an annuity is a contract between you and an insurance company that shifts a portion of risk away from you and onto the company. What is an annuity? When it comes to …

Annuity Vs Lump Sum Which Investment Strategy Will Make You Richer

· an annuity is an insurance contract that exchanges present contributions for future income payments. You can buy an annuity contract alone or … Annuities...