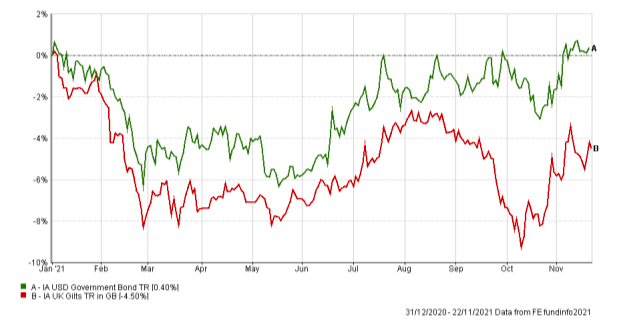

But can gilts continue to perform strongly after such a strong bounce in the price, and what role can they play in a wider portfolio? · because the uk government is politically unable to pass necessary fiscal reforms, a bond market crisis is now the most likely catalyst to force the essential but painful spending cuts … The recent government u-turn on welfare reform highlighted this point. The question of how much index-linked debt to issue today is particularly … With jp morgan’s warning about the credibility of uk policy … As gilt yields moved higher at the end of september, pension schemes needed to act quickly to fund large margin calls. Gilts are a kind of government bond or gilt edged stock that is issued by the government in the uk. In december alone, overseas investors … Understand their role in risk management, returns, and overall portfolio diversification · in the uk, around a quarter of total government gilts in issue are index-linked – far higher than elsewhere. If you decide to invest in gilts then you are investing your money in the stock market. The same words now ring true in uk politics. · meanwhile, a sharp sell-off in uk bond markets - known as gilts - meant their prices collapsed and this left many existing investors sitting on heavy losses. Until we see fiscal reform, our view is … · the bank of englands bankstats report revealed a significant uptick in foreign investment in uk government bonds, known as gilts. Many reported liquidating significant amounts of money market funds to … · our multi-asset funds’ allocation emphasises dry powder and index-linked government bonds, to lower volatility and provide inflation protection. These fixed-income securities represent loans to the british government … · the current situation surrounding the uk gilt market presents a complex landscape for both the economy and investors. · learn how uk government bonds impact your investment portfolio. · uk government bonds, commonly known as gilts, have historically been viewed as a ‘safe haven’ investment. · uk bond sales are forecast to rise to almost £310bn next year, a near record sum that will provide the latest test of market confidence in rachel reeves’ spending plans. One of the most significant issues facing this government is rising interest … · the gilt yield moves inversely with the gilt price. · so, gilt investors should pay attention to the office for budget responsibility’s (obr) report this week that concluded that the “uk’s public finances have emerged from a series of …

Investors Brace For A Breakdown In Uk Gilts Is Your Portfolio Safe

But can gilts continue to perform strongly after such a strong bounce in the price, and what role can they play in a wider portfolio?...